BOSTON — North Shore rents are mirroring the region’s escalating rising single-family home prices, according to new data from CoStar Group Inc.

The global real estate tracker reports rents are on the upswing as demand is high while the apartment vacancy rate is low.

“The lack of construction on the North Shore is driving rents,” said Mark Hickey, a CoStar market economist who authored the report.

CoStar, a Washington, D.C.-based company, with offices in Boston, tracks nearly 7,000 units in Lynn, Lynnfield, Marblehead, Peabody, Saugus, and Swampscott.

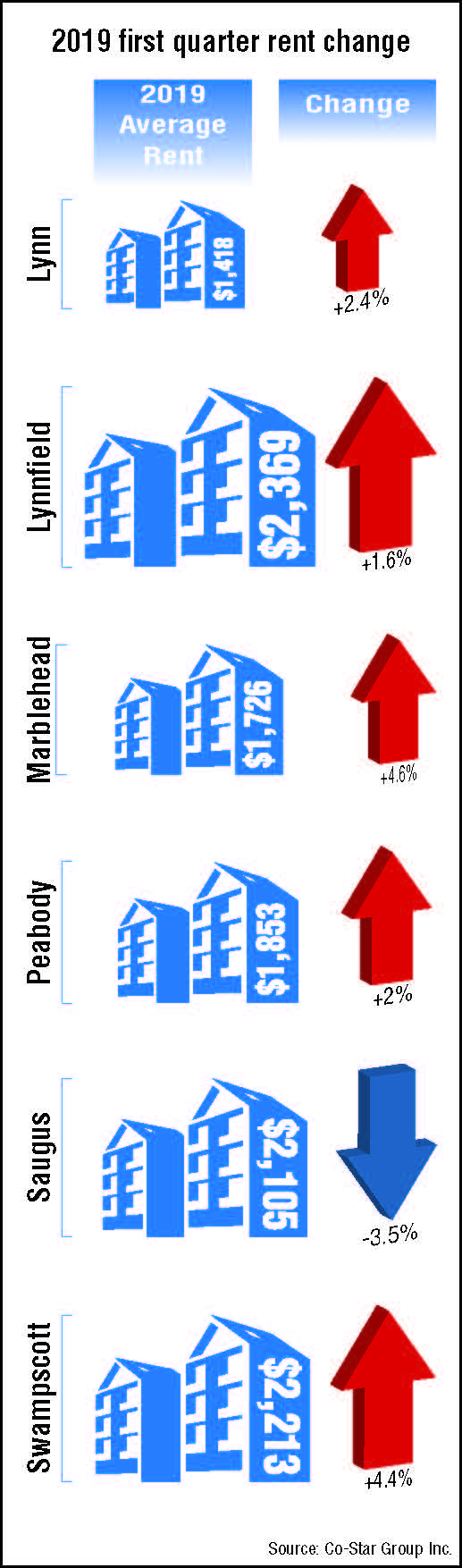

The average rent in the six communities in buildings with eight units or more was $1,910 in the first quarter, up from $1,875 for the same period one year ago, a nearly 2 percent hike.

But a closer examination of the data by community reveals year-over-year increases range from 3.4 to more than 7 percent.

The biggest rent growth was in Swampscott where the cost of a one-bedroom apartment increased by 7.5 percent to $1,978 in the first quarter, from $1,840 one year ago.

In addition to the lack of new units, brokers say rents are being driven by a strong economy that has allowed adult children, who had been living with their parents or multiple roommates, to get their own apartment.

One of the other factors contributing to rising rents is vacancy rates in the low single digits. In Lynn, just 80 of 3,197 units were empty in the first quarter, or 2.5 percent. There were 13 vacant units in Lynnfield for a 3.4 percent vacancy rate. Of the 2,487 units tracked in Peabody, just 67 or 2.7 percent are empty.

In addition, agents say potential tenants priced out of Boston and other communities closer to the city, are moving to the North Shore and driving up prices.

Consider these numbers: a studio apartment in Boston’s downtown neighborhoods in the first quarter averaged $2,679, a one-bedroom fetched $3,252, and a three-bedroom cost a whopping $4,365, according to Apartment Guide, a division of RentPath LLC, an Atlanta-based online real estate marketplace.

The most expensive apartments north of Boston are in Lynnfield where the average rent for a two-bedroom unit was $2,746 from January through March, a 4.5 percent increase from $2,627 for the same period one year ago.

Jessica Buonopane, vice president of residential properties at National Development, the Newton company which owns MarketStreet Apartments in Lynnfield, the 180-unit complex off Route 128, said the town’s location and great schools make it a desirable place to live.

“Our demographic tends to be families attracted by the school system and empty nesters who raised their family in Lynnfield and don’t want the responsibility of homeownership, but want to stay in town with retail next door,” she said.

In Lynn, studio and one-bedroom apartments saw modest increases of about 1 percent in the first three months of the year. But two-bedroom units cost 3.4 percent more than a year ago at $1,618 while the average three-bedroom rose to $2,081, up 4.6 percent from $1,989 a year ago.

Tenants won’t find any bargains in Swampscott where the average one-bedroom cost $1,978, a 7.5 percent hike from a year ago when the rent was $1,840.

Rounding out the three highest-priced communities is Peabody, where average rent for a one-bedroom swelled by 3.6 percent in the first quarter to $1,583, up from $1,528 last year. Two-bedrooms saw average rents rise 1.3 percent to $2,022, and three-bedroom units were unchanged at $2,359.

Marblehead experienced rent hikes of 4.6 percent overall compared to a year ago. A two-bedroom cost $1,786, up from $1,650 last year.

The outlier was Saugus, the only community where rents declined in the first three months of the year. The average price for a one-bedroom unit fell by 4.2 percent to $1,837 and rent for a two-bedroom dwelling dropped to $2,373, a 3 percent slide.

CoStar’s Hickey said while there has been very little construction of new apartments in Saugus, the hundreds of apartments built in nearby Malden Center and Revere is likely keeping Saugus rents down.