SWAMPSCOTT– The select board on Wednesday continued to address the FY2023 tax rate classification. With some unknown factors, several steps need to be done before the first actual tax bills are issued.

In order to talk about tax classification, it has to come to an understanding that the select board has the option to shift tax from residential to commercial or the other way around. It is about a balance between which factors pay more, whether residential or commercial, and how it would affect the town financially now and in the future.

According to the presentation by the town assessor Richard Simmons, although every dollar amount of commercial, industrial and personal property is increasing from 2018 to 2023, the percentage of commercial property is decreasing, and the percentage of personal property is taking its place. In other words, the property market is growing disproportional and the levy shifts to the residential base.

It is not ideal for the economy of Swampscott, according to the Select Board.

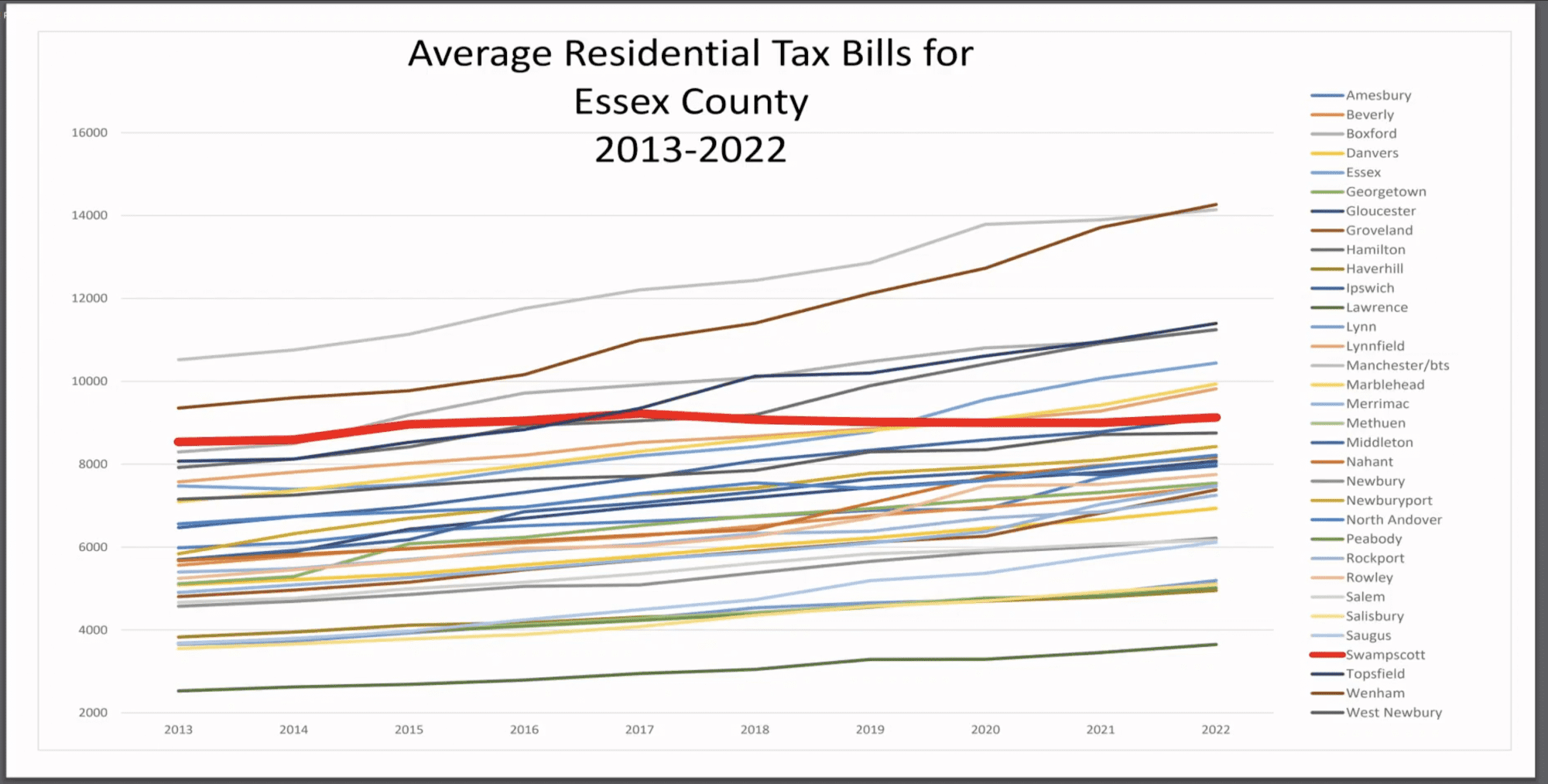

From 2013 to 2022, the average residential tax bills of Swampscott have slowly dropped in rank in Essex County, from third to eighth place. In order to maintain this positive impact, the Select Board tried to seek a balance in levying.

Because the current year’s Free Cash amount is unknown and expected to be clear before the end of November, the tax rate modeling will be reviewed at the November 30 Select Board meeting.

Then on December fifth at the Special Town Meeting, the town will appropriate money from the Free Cash and Stabilization Fund to offset the debt service for the new school and tax levy. Based on the financial policies, the town currently has 12.9 percent of the annual operating budget reserved, which is a very good amount, according to the treasurer of the town Patrick Luddy.

After a special town meeting, the select board will set the tax rate for FY2023. At the end of December, the first actual tax bill will be issued.