LYNN — Despite being majority-minority, the homeownership rates in the city for minority populations lag behind the homeownership rate of white residents.

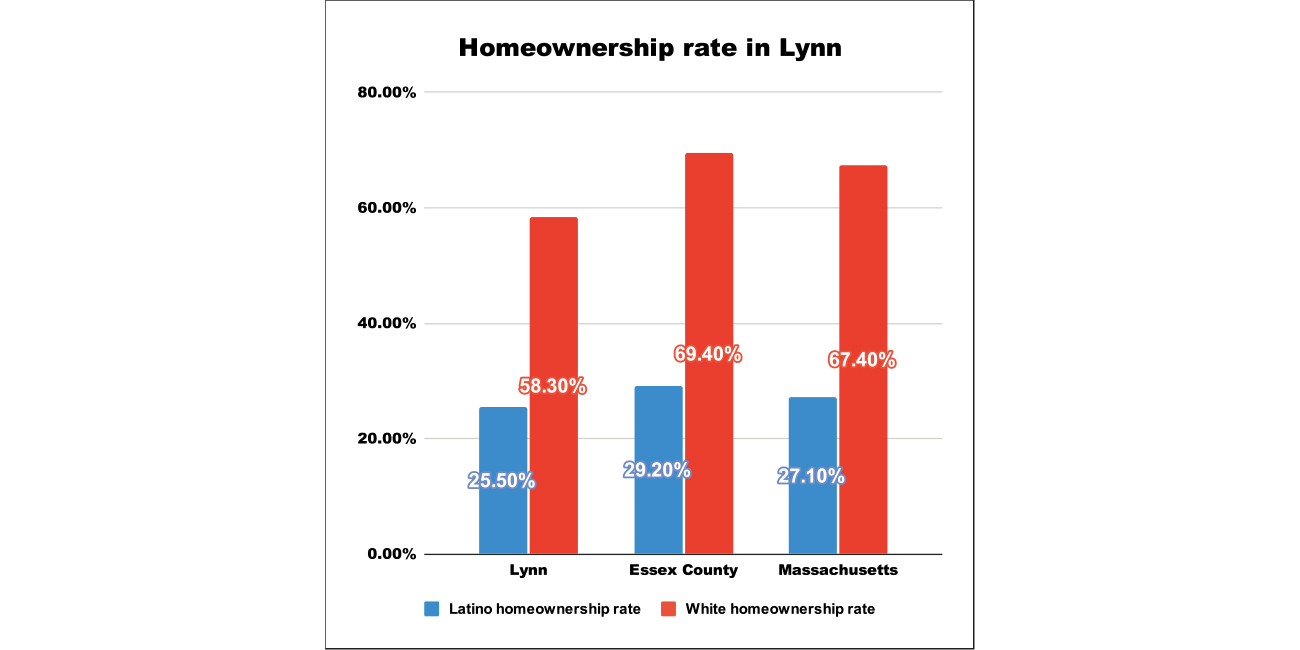

According to a June 2023 report from the Woodstock Institute for the Partnership for Financial Equity, which looked at housing data from 2021, homeownership rates in the city across the board lagged behind state averages. That includes among white residents, who had a homeownership rate of 58.3%, which was around 9% below the Commonwealth’s average.

Based on the population dataset used by the Woodstock Institute, Latinos made up the largest percentage of Lynn’s population at 42.8%, and had the lowest homeownership rate in the city among identified racial groups. Just more than 25% of Latinos in the city are homeowners, below the Commonwealth’s 27.1% average for Latino residents. The homeownership rate for Latinos in Lynn also falls short of Essex County’s Latino homeownership rate of 29%.

Woodstock Institute Senior Research fellow Spencer Cowan said in Lynn, Latino homeownership, and minority homeownership in general, follows many of the trends across the Commonwealth that showed low rates compared to white homeownership.

“Latinos in Lynn are disproportionately renters,” he said. “A higher percentage of whites are homeowners in Lynn than Latinos.”

However, Cowan noted that Latino homeownership is increasing in gateway cities like Lynn, with the number of mortgages outpacing the percentage of the population, something he said means Latino homeownership is increasing.

“Latinos are becoming homeowners more in Lynn,” he said “What I would expect to see in the next round of data is an even higher percentage of homeownership.”

According to mortgage-lending statistics in the report, white mortgage applicants from Lynn were rejected 15% of the time at Massachusetts banks and credit unions, while Latinos from the city were rejected by banks and credit unions 30% of the time.

Among other minority groups in the city, Black residents had a homeowner rate of 28%, which was short of the Commonwealth’s Black homeownership rate of 34.1%. Black residents were also rejected by banks and credit unions at a rate of 28%.

Asians in Lynn were homeowners at a rate of 46.9%, and were rejected from banks and credit unions on 23% of applications.

Mayor Jared Nicholson said the city needs to continue to support low-income and minority residents to provide a path to homeownership in Lynn.

“By continuing to invest and prioritize equitable solutions to housing insecurity, we expand programs that provide pathways toward financial stability and seek to reduce barriers to homeownership,” Nicholson said.