MARBLEHEAD — During a recent Select Board retreat, Chief Financial Officer Aleesha N. Benjamin presented a comprehensive financial update to the select board.

Her presentation detailed long-standing inefficiencies, hopes to modernize outdated systems, and build a transparent, resilient financial infrastructure for the town.

“This is going to be exciting. It’s going to be a complex new learning curve,” she said, but emphasized that the changes will resolve systemic issues and improve performance across the board.

The department has completed a critical transition from the outdated ClearGov platform to Munis, an enterprise-level municipal financial software. The Town began using Munis on July 1, with payroll integration set for January 2026, and revenue collection and assessing to follow by July 2026.

“Instead of our little paper timesheets, we can go in and enter,” Benjamin said. “It’s a better platform for them. It’s just the learning curve.”

This move enables real-time data access, improving internal efficiency and public transparency.

While ClearGov will remain active temporarily to ensure flow, eventually Munis will serve as the Town’s central financial platform.

“We’re not trying to get away from [ClearGov] yet,” Benjamin said. “There’ll be no gap for the public missing any data.”

ClearGov, originally adopted for its transparency tools, will remain operational until Munis has a full year’s worth of integrated data across payroll, revenue, and general ledger. The goal is to provide “a Transparency Center [that] shows at least a year’s worth of data,” Benjamin said.

Board members emphasized the importance of ensuring continued public access to budget data. “There’ll never be a time when we’re not having transparency,” said Dan Fox, chair of the select board.

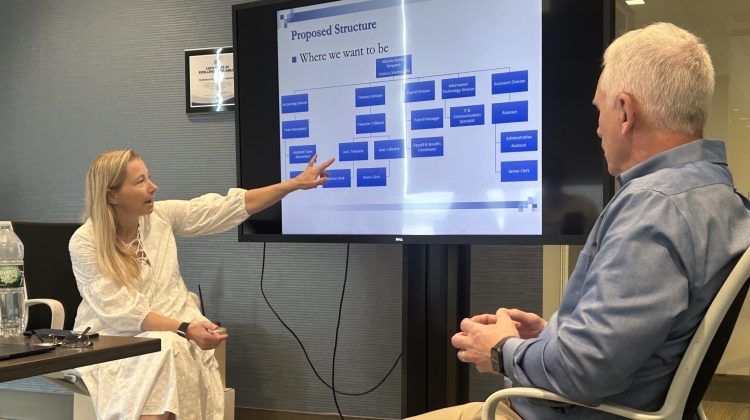

Another component to Benjamin’s presentation was a restructured finance team to address critical gaps and improve continuity. Previously, only one town accountant handled all journal entries and reporting — with no backup.

“There should be an assistant town accountant to do journal entries, more complex accounting tasks,” Benjamin explained. “That also is succession planning.”

Treasury and collection functions are also being split to allow for specialization and better support. The plan includes having one assistant treasurer and one assistant collector to help create advancement opportunities for current clerks.

“If we ever lost our treasurer collector, we have two positions that either one of them could sit in there,” she said. “That’s a key goal.”

These changes would only require adding one new position and upgrading existing roles to meet current operational needs, Town Administrator Thatcher Kezer said.

The town has hired a new audit firm to bring financial reporting up to date and meet required deadlines.

Benjamin expects the annual audit and single audit to be completed by early 2026, enabling earlier certification of free cash and improving budget forecasting.

The Select Board voiced interest in using last year’s actual spending data alongside budget comparisons to improve fiscal decision-making. “Seeing last year’s actuals … is the gold standard at the end of the day,” Board member Moses Grader said.

Benjamin agreed, noting the new system will allow for year-to-date actuals in real-time. “Running year-to-date actuals is the simple thing,” she said.

Looking ahead, the town plans to explore Munis’ online payment platform, and open finance tools to further streamline operations and enhance public engagement.

“If we went to the Munis online payment platform, it’s fully integrated,” Benjamin said. “Payments will go in, link to the account for real time.”

She also noted efforts to prepare an enterprise risk management plan and OPEB (Other Post-Employment Benefits) liability funding strategy. “I’m working with the town administrator to address past inefficiencies and bring stronger financial cultures in the form of a team approach,” she said.