MARBLEHEAD — At its recent tax classification hearing, the Select Board, acting on the recommendation of Assistant Assessor Todd Laramie and the Board of Assessors, approved a FY26 tax rate of $8.60 per $1,000 of assessed value, a level lower than the town has seen in years.

Last year’s tax rate was $9.05.

Despite the rate reduction, many homeowners will still notice slightly higher tax bills in January due to rising property values.

Select Board members noted that the drop in the rate is partially due to long-term debt from the high school project finally coming off the levy after more than two decades, easing the amount the town needs to raise through taxation.

Consistent with Marblehead’s long-standing approach, the Board again adopted a single, uniform tax rate for both residential and commercial properties. With commercial and industrial parcels making up only about 4% of the town’s taxable value, Laramie explained that a split rate would offer minimal savings for homeowners while placing a disproportionate burden on a small segment of local businesses.

Laramie reported that the total assessed value of all taxable property in Marblehead has climbed to $9.89 billion, an increase of 6% in the prior fiscal year. He attributed the growth largely to ongoing market strength reflected in 2024 real estate sales, which the FY26 assessments are based upon.

While the market has started to show signs of settling, Laramie emphasized that the last several years have been marked by unusually intense sales activity across the region.

Residential and commercial trends:

- Average residential value: up 6.07%

- Average commercial value: up 4.29%

The average single-family homes assessment increased from $1.217 million to $1.291 million for FY26. With the new rate applied, the typical homeowner’s bill will go up by about $75, moving from $11,019 last year to roughly $11,094 this year — a change of approximately 0.7%.

The median single-family home is also rising in value, increasing from $956,000 to $1,010,100.

According to this year’s assessments, the Eastern Yacht Club’s clubhouse is the most valuable property in town at $16.286 million. The most valuable residential property, and the only one valued at more than $10 million, is 17 Crowninshield Road at $11.405 million. This home was recently listed for sale at $18 million.

Although the tax rate is the lowest in recent memory, Marblehead’s overall property valuations continue to climb, meaning the amount due for many homeowners still edges upward.

Under Proposition 2 1/2, the Town cannot increase the total property tax levy each year more than 2.5%, plus additional revenue from new growth. Any increase beyond that limit requires both Town Meeting approval and a townwide ballot vote.

New growth, which captures value from new development or significant improvements, continues to cool. Town Administrator Thatcher Kezer noted that building permits have declined, reflecting a pullback from the pandemic-era surge, when many residents invested heavily in home offices, expansions, and renovations.

Laramie added that Marblehead’s new-growth pattern differs from larger cities: major commercial projects are rare, and much of the town’s growth stems from residential tear-downs and large-scale rebuilds, some of which transform modest former homes into multi-million-dollar properties. Tracking these multi-year construction projects — and valuing them appropriately mid-build — remains a key focus of the assessor’s office.

During the meeting, Laramie reviewed several optional exemptions available under state law.

The Board ultimately recommended against adopting any of them:

- Residential exemption: Would shift taxes from lower-valued owner-occupied homes to higher-valued ones but provides almost no net benefit in a town where nearly all residential parcels are already owner-occupied.

- Commercial exemption: Would reduce taxes for small businesses but increase them for larger ones; given Marblehead’s mostly small business community, it would have little positive impact.

- Open space discount: Not applicable because Marblehead has no qualifying parcels under the state’s definition.

The Board reaffirmed that maintaining a single tax rate remains the most equitable structure for Marblehead.

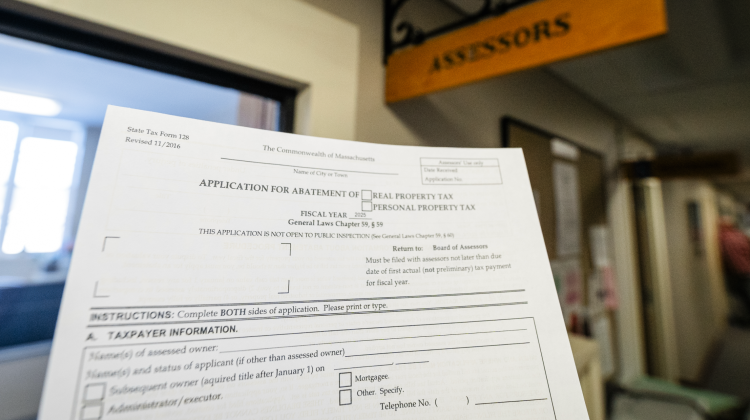

Laramie shared that his long-standing familiarity with Marblehead’s neighborhoods helps him explain assessment differences and respond to taxpayer concerns. He encouraged residents to visit the assessing office with questions, emphasizing the department’s open-door approach and commitment to transparency.